Mining Profitability and ASICBoost

Guy Corem, former CEO of Spondoolies Tech, posted recently on the savings of ASICBoost. In this article, I hope to show exactly what his numbers say, what can possibly be in dispute and why his estimate of $2M savings is so divergent from Gregory Maxwell’s $100M payoff.

A Little History

Spondoolies Tech was a Bitcoin ASIC manufacturer until 2016 and they brought several miners to market. Unfortunately, like every other Bitcoin ASIC manufacturer, they weren’t able to compete against BitMain and went out of business. They also had a patent that’s very similar to overt ASICBoost, so Guy is in a very good position to know what the actual costs are.

Guy’s Numbers

Guy posted an equation on his post to calculate the savings of ASICBoost to Bitmain. I will, for the sake of clarity, simplify this equation:

Savings = Bitmain’s Hash Rate * Mining Equipment Efficiency * Cost of Electricity * ASICBoost Savings

Bitmain’s Hash Rate refers to how many hashes per second all their directly controlled miners calculate. Guy’s estimate here is 500 PH/s or about 13.2% of the network. This is can be done with about 40,000 Antminer S9’s (each of which get roughly 12.5 TH/s and cost about $1200).

Mining Equipment Efficiency refers to how much power is used to calculate 1 GH. Guy’s number here is 0.1 J/GH, which is in the specification of the Antminer S9.

Cost of Electricity refers to how much power costs. Guy’s estimate here is $0.03/kWH.

ASICBoost Savings refers to how much efficiency you can get using ASICBoost. Guy states this to be 15%.

If you plug in the numbers, you get 15% of $13M, or $2M in savings per year.

Greg’s Numbers

Greg stated in his post to the bitcoin-devs mailing list:

Exploitation of this vulnerability could result in payoff of as much as $100 million USD per year at the time this was written (Assuming at 50% hash-power miner was gaining a 30% power advantage and that mining was otherwise at profit equilibrium).

A lot is included in between the parentheses (not uncommon for Greg), so let’s unpack it. His first assumption is that mining is at a profit equilibrium. That means that electricity cost equals Bitcoins generated. There are around 12.5 (plus fees) BTC generated every 10 minutes or 657,000 BTC per year or $723M/yr at the time of his post.

His equation, then is something like:

Savings = Unnamed Miner’s portion of the overall hash rate * Total Cost of mining per year * ASICBoost savings

Unnamed Miner’s portion of the overall hash rate is 50% in Greg’s assumption.

ASICBoost savings is 30% in Greg’s assumption. (or 20% and may be a typographical error, more on that below)

Total Cost of mining per year is, as stated, $723M/yr.

Plug these in and you get $108M/yr, which he seems to have charitably rounded down to $100M/yr.

What’s in Dispute

The method of calculating these numbers is pretty different, but they boil down to these three disputes.

- ASICBoost Savings — Greg says 30%, Guy says 15%

- Portion of the network that Bitmain directly controls — Greg says 50%, Guy says 13.2%

- Cost of electricity needed to produce $1 worth of Bitcoin — Greg assumes $1, Guy says current costs are around $0.137

Let’s look at each claim.

ASICBoost Savings

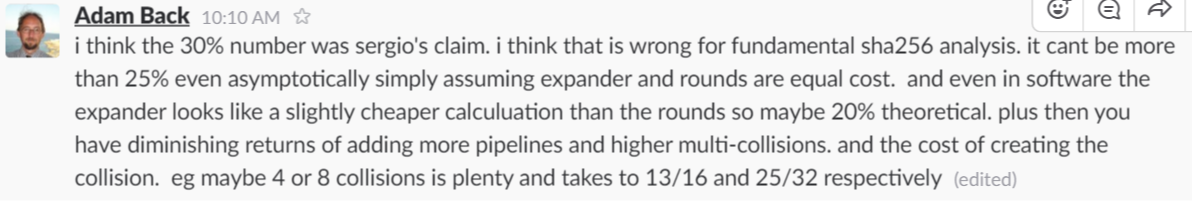

This gets a little bit technical, but the essence of ASICBoost is that instead of doing roughly 4 equal functions, you can precompute 1 and do 3 each time instead. For that reason, the theoretical limit to the savings is actually 25% as Adam Back says here (from Bitcoin Core Slack channel #tech-chat):

The engineering reality is that with all the cost for finding collisions in covert ASICBoost, the actual savings is at most 20% and 15% is actually a good estimate. That said, this is the smallest disputed amount, and actually doesn’t materially change Greg’s claim very much ($80M instead of $100M when you account for block fees, etc). Also, Greg mentioned 20% earlier in his email and may just have made a typographical error in the sentence I quoted.

Network Hash Power Directly Controlled

AntPool’s Hashing power currently is about 17%. This includes people that own and run miners in another geography and mine at that pool. Nobody (other than Bitmain) knows the actual proportion of miners that AntPool directly controls, but it’s likely to be something lower than 17%. 13.2% (500 PH/s) sounds like a reasonable figure as given by Guy.

That said, there are other pools that Bitmain may control and 50% is a purely theoretical number from Greg’s estimate. I will point out here that Stratum (the protocol for communication between pools and mining equipment) does not support overt or covert ASICBoost. In order for 50% to be using covert or overt ASICBoost, the equipment would need to be using a protocol other than Stratum to communicate with the mining pool. This would be easy to notice and thus far, no evidence that such communication between equipment and pool has taken place (on mainnet for overt ASICBoost, on mainnet or testnet for covert ASICBoost) exists.

Cost of Electricity Needed to Produce $1 Bitcoin

This is the biggest cause of the divergent estimates and is interestingly, the easiest to determine. Guy’s estimate comes from the Antminer S9 specifications and the current network difficulty. These are all published and well known and anyone can go to a Bitcoin Mining Profitability calculator and see that he’s correct.

That said, what Greg was talking about is the theoretical limit, which is the equilibrium point at which new mining equipment is unprofitable to be introduced onto the network. Generally, the network converges to that point, but when you have Bitcoin price appreciation as we’ve had the last 6 months, the network will generally be way below this equilibrium point until manufacturing has a chance to catch up.

Bitmain Profitability

Using Guy’s numbers we can get a rough estimate for how profitable Bitmain’s mining venture is. They have 13.2% of the network and there will be about 735,000 in Bitcoins made through mining this year. Thus, Bitmain will get around 100,000 BTC. At today’s prices, that’s ~ $120M.

Their costs are electricity (which is $13M from above) and the costs of the miners themselves, assuming they last a year ($1200 for S9 * 40,000 units ~ $50M). They make $60M before accounting for the costs of a data center, which we can roughly estimate at $10M, including cooling, personnel, racks, routers, etc.

$120M in revenue and $70M in costs mean $50M in profit.

If this seems high to you, remember that this equipment was largely made and designed when Bitcoin prices were much lower. At $700/BTC, Bitmain breaks even. At $130/BTC, Bitmain can only pay the electricity costs (this is the theoretical equilibrium point from Greg Maxwell’s estimate). (Edit: see this post for an update)

Conclusion

The main takeaway is that Guy and Greg are both right (except possibly for the ASICBoost savings part for Greg) and they’re really talking about two different things.

Guy is talking about the current state of the network and Bitmain’s current savings to use ASICBoost. Essentially, he’s saying it’s not worth it for Bitmain now to use ASICBoost since it only saves $2M in a business that’s making a lot more.

Greg is talking about the theoretical future state of the network and a miner’s potential savings should the network reach a theoretical equilibrium point. Essentially, he’s saying that the it may be worth it for a mining company to benefit greatly in using ASICBoost in the future.

In other words, much like a lot of the dialogue in Bitcoin, two people can sound like they’re disagreeing, but are actually both telling the truth. There’s no need to accuse people of dishonesty.

Comments are closed