The Triumph of Post-Modern Investing

“The market can stay irrational longer than you can stay solvent.”

— John Maynard Keynes

To say that the current market is irrational would be an understatement. Stock prices are at historically high multiples of revenue. Bonds return almost nothing in the US and have negative rates in Europe. Real estate is reaching all time highs with such high demand that prices are going up 10% in a single month.

These are not even the craziest thing going on in the market. With unprofitable companies, such as WeWork, there’s at least some prospect for future growth to make up for the large premium, but with the asset bubbles going on today, there’s not even that.

We’ve seen assets pump with little to no fundamental underlying value, including companies with little prospects for growth (AMC, GameStop), bankrupt companies (Hertz), and of course, negative rate bonds.

The past decade has shown a rise in this seemingly irrational market behavior. Specifically, that of investments being based on popularity rather than fundamentals such as cash flows or earning potential. In this article, I’m going to explain the reasons behind the current irrationality, the philosophical worldview led us here and the spiritual implications going forward.

No Yield

There is little to no yield to be found anywhere in the market today, especially when inflation is taken into account. Bonds aren’t returning very much and few stocks even have dividends. When it comes to housing, rental income is a pittance compared to the cost.

Why is this the case? The reason the yields are so low is because the asset prices are really high. Historically, it was common for stocks to pay 10% dividends, back when we were on the gold standard, for example. Yield is correlated with the cost of capital and under the gold standard, the cost of capital was high and so was yield. Currently, there is much more money available than it was then. This shows up as very low interest rates and more money is chasing the same amount of assets than when yields were higher. In other words, as assets get bid up, the yields go down.

So how did we get here? The reason why the cost of capital is so low is due to the actions of the central bank (aka The Fed). The money supply in every country has expanded significantly since 2008 and has accelerated in the past year. The additional money that comes into existence go to people who would rather store that value than spend it, which leads to investment in assets, driving yields lower and lower.

Another way to look at the current market is that central banks have attempted to de-risk everything through a policy of rescuing anything close to bankruptcy by providing liquidity. There is no yield because these assets are supposedly de-risked.

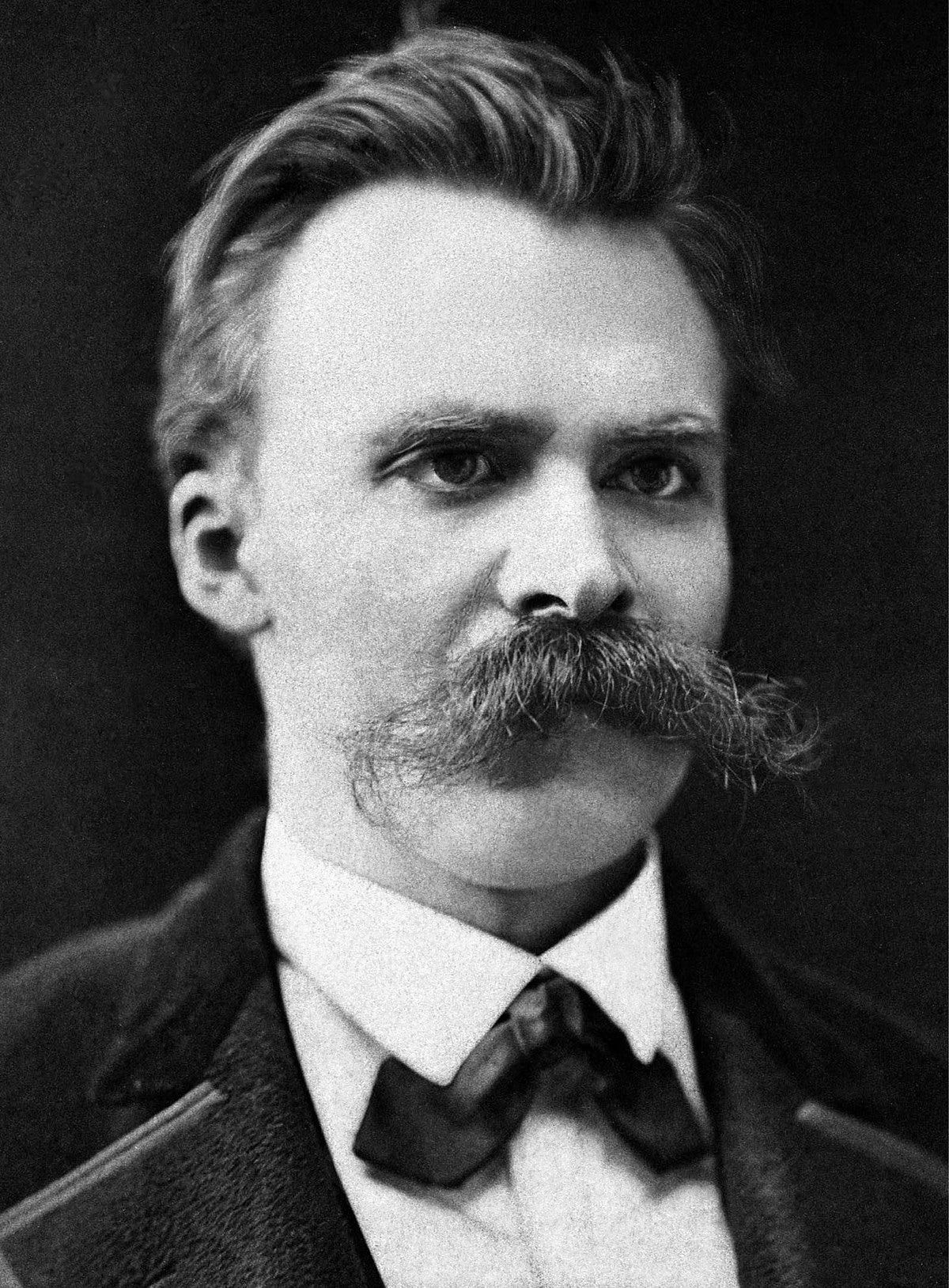

The Nietzschean Investor

At some point, yields become so low that they don’t factor into the decision to buy an asset. The price increase of the asset itself becomes the only consideration. A difference between a 1% yield or a 2% yield is trivial compared to the price increases in the assets themselves (many 30%+ per year). The investor then has to ask, what drives the price increase?

If enough people still invest based on yield, asset appreciation should still stay somewhat rational. Much like Enlightenment thinkers who rejected God but still clung to Christian morality, if there’s a critical threshold of people who believe one thing, the rest of the market is rational in following it. But what happens when there is no critical threshold? What happens when most of the market doesn’t make investment decisions based on fundamentals and instead just cares about what everyone else is buying?

This is reminiscent of what Nietzsche asked about: what is morality without God? The Enlightenment thinkers before him tried to hold onto Christian morality without Christ. As Nietzsche pointed out, this was inconsistent and moreover, wimpy. If God doesn’t exist, then morals based on God need to be thrown out with it.

In the investing world, what we’re seeing is that fundamentals like yield and profit are being thrown out and replaced with popularity. The fundamentals matter less and less in a world where anything too big to fail gets rescued. So what’s left?

Investing based on popularity is much like asking what is morality without God. As Nietzsche argued, when you remove God from the morality equation, you’re left only with the human will. As a Godless philosophy took hold, we found that culture went to post-modernism, or radical relativism. In the same way, as money has been diluted over the past 100 years, it’s taken out fundamentals and civilization building with it. The market has removed fundamentals like yield and profit, and the only thing left is popularity, or collective will.

In other words, just as we’ve gone from morality based on God to morality based on will, we’ve gone from investment based on merit to investment based on popularity. Nothing quite captures this phenomenon like Dogecoin.

Altcoins

For the uninitiated, altcoins are digital tokens put into existence by a development team with promises of some vague future utility using some mentally tortured justification for a token. Think bad dot-com idea but with tokens that are sold beforehand. This is in stark contrast to Bitcoin, which has a very clear use case and has no central controller.

The spirit of post-modern investing is most obvious in the Elon Musk-pumped Dogecoin. It’s in the purest sense, a memecoin. Dogecoin has no purported usage and it does nothing technically better than any other token.

Post-modernism, of course, is the philosophy of complete relativism, where there are no absolutes and everything is relative. There’s certainly some truth to relative value. As any Austrian economist will tell you, value is subjective, and can be seen in the daily price fluctuations of nearly every commodity in the market.

Post-modernist investors take it a step further and decide that value is not just subjective, but can be controlled. Instead of a critical threshold of people that invest based on fundamentals, post-modern investors are a critical threshold of people that invest based on will-to-power. Essentially, they believe they can change asset prices as if it’s a vote. These are purposefully irrational actors imposing their irrationality on the market.

Irrational Behavior?

Yet we have to wonder, are they being that irrational? When the dollar supply continuously expands, it removes the basis by which we can measure anything else. The dollar expansion has made the cost of capital cheaper, destroying yield, making measurement of stocks particularly difficult.

Companies that return zero dividends in perpetuity should be worth zero, yet companies like Amazon have some of the largest market caps in the world. What is the fundamental value here? The potential to get dividends 20 years from now? That hardly seems worthwhile and the discount on such future dividends should make such stocks worth much less, yet they continue to soar. The reason for the large market cap is because of a shared belief in its value. In other words, it’s based on popularity. The stock market without dividends really is a Keynesian Beauty contest.

Which leads us to the question. What’s the difference between Amazon and Dogecoin? At a fundamental level, the investor isn’t getting a dividend from either one so the only reason for buying is a potential price increase. If it’s going up, doesn’t that accomplish the goals of the investment? From a post-modern perspective, this is a compelling argument. Yet, from a moral investor’s perspective, this is a horrifying conclusion and literally de-civilizing.

Nietzche argued for a will-to-power morality. That is, a morality where anything was permissible in order to get more power. Will-to-power is a might makes right philosophy in a Godless world. Power trumps morals.

Similarly, popularity of any kind, which makes the price go up without any regard to whether anything is being built is the only consideration in a yieldless investment world. Popularity trumps merit.

A Post-Modern World

Popularity trumping merit is not an unknown pattern. Our democracies are not run by the most qualified, and wisest leaders, but the most popular. Bureaucracies of all types promote those who are least objectionable, not the most capable. Popularity trumping merit is a recipe for poorer quality and we’re seeing that in droves. This way lies the slow decline of civilization.

Much as morals have declined with the rejection of God, civilization itself has declined with the rejection of merit. This is no small matter as investment in the wrong things is slowly breaking down civilization into a sort of nihilistic, valueless state.

The question for the moral investor is, what do we do? An investment without yield is not strictly an investment, it is speculation, or less charitably, gambling. Are we investing in something that’s being built that’s good for civilization or just speculating? If you view speculation/gambling as immoral, what alternatives are there? Do we participate in post-modern/popularity-based/de-civilizing speculation? Or do we do something else?

Conclusion

The continuous money printing has put us in a position where yield matters less and less and that is simply not sustainable. Companies that don’t make money have to be continuously subsidized. That subsidization comes through monetary expansion, which works until it doesn’t. Unsustainable debt doesn’t simply go away. Furthermore, investment based on popularity disincentivizes building that which is useful for that which is popular. Merit is being thrown out by the wayside.

There’s a reckoning coming that every Christian should be familiar with. The rejection of merit is much like the rejection of God. Both lead to destruction.

The current moral landscape is dominated by post-modern values. The various -isms are the new commandments of a fickle and arbitrary post-modern god. The way to fight post-modern values is to hold onto a God-based morality, not to submit to the post-modern hegemony. In the same way, the way to fight post-modern investment strategies dominating is to hold onto merit-based investment strategies.

This seems counterintuitive since the goal of investment, we are told, is to make money. But that’s not what Christianity is all about. We should care deeply about how we affect the world through our investments and if the investments we make bring about the discrediting of merit and ultimately the collapse of civilization, we need to take that into account.

After all, holding Christian values in a post-modern world causes us to suffer. Why are investments excluded from such calculations?

Comments are closed