Why You Can’t Shortcut Trust

Trust is one of those words that is both loaded and ill-defined. We all recognize that trust is very important for nearly all human interactions, especially trade. The actual mechanics of trust, however, are not really well articulated or understood.

How do people trust in something? Why is trust important in money? More importantly, what does this have to do with bitcoin? In this article, we’ll cover how trust in a money is established.

Trust in a money requires time, and any successful currency needs to optimize for longevity over everything else.

The Mechanics of Trust in Money

At its core, money is all about trust: enough people need to trust that the money is something that will keep its value, or else they won’t want to hold it. And if people don’t want to hold it, money will tend to trade at a discount until it becomes all but worthless.

Historically, people have trusted glass beads and Rai Stones as money due to their rarity, but their desirability was lost as soon as someone figured out how to easily reproduce them. For people to trust something as money, scarcity needs to be guaranteed. But scarcity is just one of many characteristics that we want in a money.

Ideal Characteristics of Money

As many others have noted, the ideal characteristics of money are scarcity, durability, censorship resistance, recognizability, fungibility, divisibility and portability. We can broadly separate these into two different categories:

- Qualities that make money convenient or easy to transact in. Divisibility, portability, fungibility and recognizability all fit into this category.

- Qualities that make money valuable. This includes whether someone else can debase or steal your money without your permission. Scarcity, durability and bearer instrumentation all fit into this category.

Bitcoin has many of these properties, but what sets it apart from other forms of money is that Bitcoin is both digital and decentralized.

Many moneys are digital (US Dollar, World of Warcraft gold, Linden Dollars), but no digital money until Bitcoin was actually decentralized. Likewise, many moneys are decentralized (gold, silver, salt), but until Bitcoin, none was actually digital. Decentralization is actually what give Bitcoin its value and digitization is what gives Bitcoin its convenience.

The Desire for Scarce Things

Humans have an innate desire for scarce things. This is evident in advertising. One of the easiest ways to get someone to buy a product is to convince them that it’s rare. When people are convinced something is rare, they have a tendency to want it.

The value they assign, however, depends entirely on how long they expect the item to remain scarce.

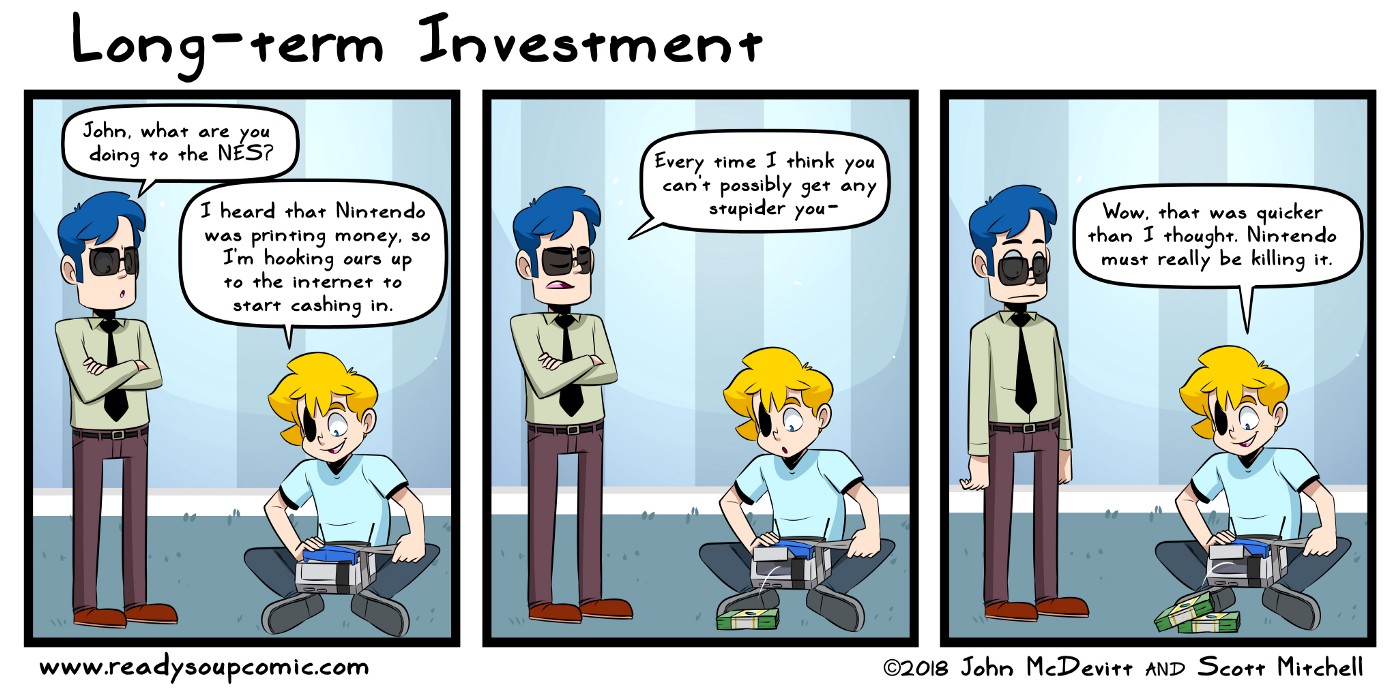

Certain goods have, as they say, a limited shelf life. When the Wii first came out, it was trading for a lot more than retail price because Nintendo didn’t produce enough units. In other words, Wiis were scarce.

As production caught up, however, the price dropped. Nobody bought Wiis to hold for 5 years to sell again. They either bought to flip or they bought it to play with.

The lesson here is that in order for scarcity to work for money, it needs to stay scarce.

Two other properties required to establish trust

Long term, people must have a good reason to believe that the scarcity of a money will last. The expectation of long-term scarcity of a money is what causes people to trust in a money. Ideally, that scarcity would be immutable.

The other property is a bit more subtle: a money needs to be a bearer instrument so that third parties can’t just seize the money at whim.

What’s important to notice about both immutability and bearer instrumentation is that a money can’t have either property if there’s a central point of failure. That is, if someone other than the nominal owner can remove its scarcity or confiscate it, then the owner needs to trust the other entity to not do those things.

This is generally not a good bet. You may trust the actions and judgment of the current central authority, but there’s no guarantee that they will be in control forever. In fact, most centralized organizations collapse because the temptation to abuse such power eventually becomes too difficult to resist.

Keynesian Hubris

Keynesians generally try to optimize for maximum spending, and thus seek to make money as convenient to spend as possible. This is why it’s so convenient to buy nearly anything in a Keynesian system, especially on credit. Keynesians encourage impulsive spending habits as a way to keep the economy flowing. Impulsiveness tends to hurt people long-term, so in reaction, many consumers purposely make spending more difficult (freezing a credit card in an ice block is a popular method).

In that respect, Keynesians emphasize the convenience properties of money like divisibility, portability, recognizability and to some degree, fungibility, even at the expense of the value properties of money like scarcity, immutability and bearer instrumentation. Not coincidentally, various altcoins often tout these convenience properties as the reason for their existence.

Long Term Value

Long term value accrues to money that has scarcity, securability and durability. These properties are often at odds with the fast movement of money.

Greater portability often means centralizing operations so a single point can process transactions faster. Greater fungibility also may mean trusting that there is no mathematical exploit of certain security assumptions that privacy coins make.

The more trust has to be given, whether to central entities or to the difficulty of certain math problems, the less valuable the money is. In other words, making money especially fast or convenient is often at odds with security, scarcity and decentralization.

Ultimately, value accrues to the money that gains long term trust. No one would argue that a Wii is a great store of value because it traded for a lot of money at one point in time. Trust has to be earned, especially across time.

Time is the ultimate judge

The real test of long term value is time. A well known phenomenon called the Lindy Effect, asserts that the longer something has survived the longer it can be expected to survive. This is so termed because someone noticed that Broadway shows tend to last about as long as they’ve already lasted. That is, a show that’s lasted 15 years, lasts another 15 on average. A show that’s lasted 1 year lasts another 1 on average.

Money can only really gain trust with the passage of time, which means that survival matters more than anything else.

This is another reason why centralization is so terrible for long term value. Centralized entities are by their very nature, fragile. Centralized entities can’t afford a mortal failure without jeopardizing everyone else that depends on it.

Conversely, a decentralized network is by nature anti-fragile: individual failures affect a much smaller group and thus, a decentralized network can afford a lot more mistakes. These mistakes in turn help all the other members of the network to learn what not to do. This in turn, makes the network stronger.

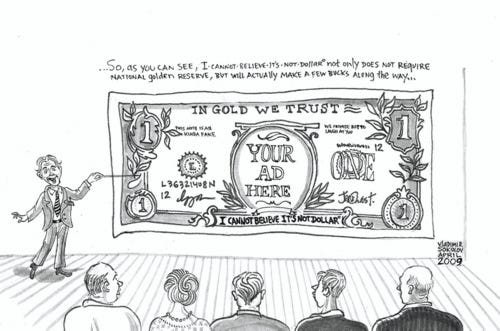

Hacking Trust

Many centralized entities try to bypass the need for long term proof by hacking trust itself. They use social signaling, hype, promises and the like to give the illusion that they’ve earned the trust, rather than actually proving worthy of that trust through time. ICOs, altcoins and hard forks have used these techniques to get people to trust them.

Unfortunately, a lot of people have been fooled by these hacks and this bear market is teaching them some expensive, but valuable lessons. At least they’re learning now when the market is still relatively small, and the population is becoming more immune to these trust hacks.

Conclusion

The priorities of Bitcoin align with long term value. The priorities of almost everything else, much like Amway and other get-rich-quick schemes, align with short term hype. Bitcoin focuses on decentralization and immutability, which provide long-term scarcity. Almost everything else promises these things, but none have Bitcoin’s track record for delivery.

Bitcoin is focused on the one thing that can prove its value. Time. As the last year has proven, this is not a 6-month game. This is a 20–50 year game. As many are finding out, it’s painful to realize you’ve been playing the wrong game the whole time. It’s not too late. The game is still just starting.

Comments are closed