Bitcoin: A Declaration of Monetary Independence

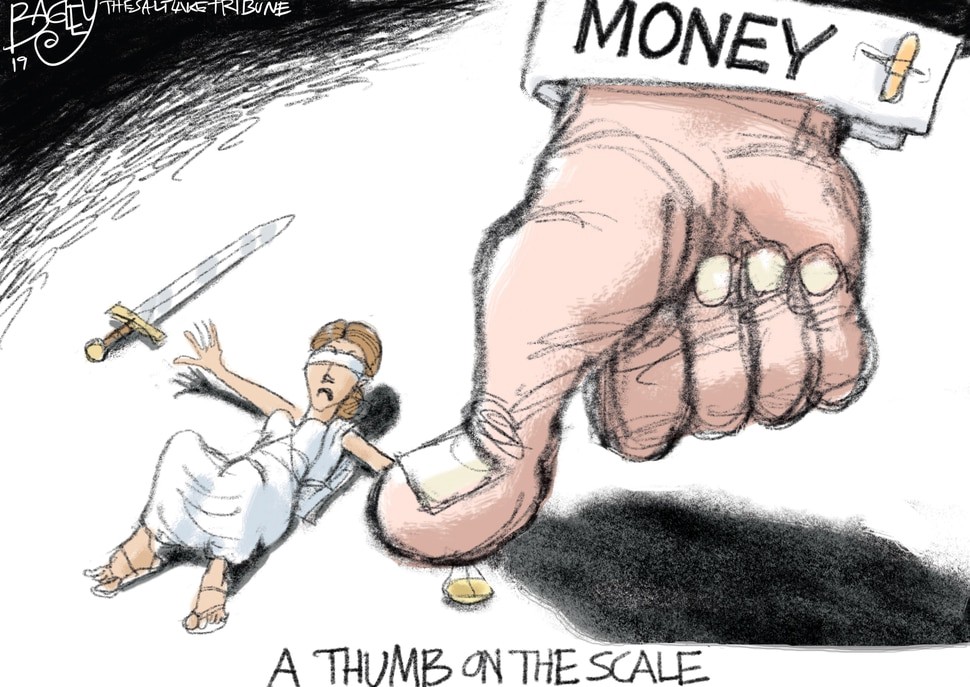

The system is rigged. We all can see it in the opulent residences of the rich in San Francisco which lie blocks away from the squalid tents of the homeless. We can feel it in the way that certain people and businesses do little to better civilization yet make ludicrous amounts of money. We can hear it in the frivolity with which certain people spend money and the morbid gravity of those whose souls are crushed by debt.

That the system favors certain people and screws over others is obvious even to a five-year-old. Why the system is so unfair is not at all obvious and is the source of much political confusion. People on the left think the rich get there through exploiting the poor. People on the right think the poor get there because they’re lazy. What’s the truth? What’s going on and why is the system rigged?

Fiat Money is Unfair

At the root of the unfairness of the current system is money. This is not the first place people look, but it is where every sound analysis leads. The system is unfair because the money itself is unfair.

To see how this is the case, let’s start with what we’ve been observing the past 4 months. Governments all around the world have spent with complete abandon. But where does that money come from? Who’s paying for all the stimuli and bailouts and grants? The amounts in these emergency measures to revive the economy in the past few months are absolutely staggering. They are well in excess of revenue these governments collect in taxes.

There are two possible answers. The money is coming from no one in particular and not paid for by anyone (something for nothing), or the cost is hidden and paid by people, just not obviously (something for something).

How Fiat Money Works

Is it really so simple? Can we help everyone who needs help just by printing more money without bad effects? Can we get something for nothing?

If it really is that simple, this leaves us with the obvious question. If the government can just print money to pay for everything, why are we paying taxes at all? If the Fed/US government can spend $6 trillion to revive the economy and it doesn’t have any other effect, why not spend $60 trillion or $300 trillion (enough to make every person in the US a millionaire)?

The fact that this hasn’t been done (and just common sense) is evidence that we can’t get something for nothing. This is a convenient lie to give the people the illusion of getting government services without cost.

Despite what we may want to believe, we can’t get something for nothing. Such claims that legislators promote are the economic equivalent of perpetual motion machines: that is, impossible.

The spending is paid for via less purchasing power or what we call inflation. So why haven’t we seen that much inflation? Hasn’t the Consumer Price Index (CPI) been 2–3% for a long time now? For USD, at least, there’s something called the “exorbitant privilege” which is the result of a particular historical event, namely the result of WWII.

The Dollar Hegemony

The dollar privilege, or dollar hegemony, is propped up through its position in international trade. Oil, in particular, has to be bought with dollars, so every company and every country has to keep some reserve in dollars (or get loans in dollars) if it wants to buy oil. Because of the dollar’s usefulness in buying oil, international trade tends to be settled in the dollar as well. As a result, the dollar has far more liquidity than any other currency. So in a liquidity crisis like we have now, capital flows toward the dollar, meaning that there’s higher demand for USD.

The demand for the dollar offsets the dollar inflation or expansion. To be more precise, it’s actually the other way around. The Fed is expanding the supply of USD to offset the crazy dollar demand around the world. This, in turn, means that other currencies depreciate relative to the dollar. In other words, USD inflation gets exported. Though the US does produce many goods that get exported around the world, the exorbitant privilege is in being able to export the dollar. The trade deficit is essentially goods that enter the US for newly printed money.

Monetary expansion (a.k.a. quantitative easing, credit facilities, loan programs, money printing) is an obscured tax. We cannot get something for nothing and $6 trillion in monetary expansion will have the effect of taking stored value from all owners of the money, which is an implicit tax. What’s more, since a lot of the dollar holders are not in the US, this effectively taxes people around the world who have no say at all in US government, let alone the Fed’s monetary policy! All those people, companies and countries that hold the dollar are getting taxed without representation.

The morality of monetary expansion is explained by a 14th century Bishop, Nicole Oresme:

For every change of money…involves forgery and deceit, and cannot be the right of the prince, as has previously been shown. Therefore, from the moment when the prince unjustly usurps this essentially unjust privilege, it is impossible that he can justly take profit from it. Besides, the amount of the prince’s profit is necessarily that of the community’s loss. But whatever loss the prince inflicts on the community is injustice and the act of a tyrant and not of a king, as Aristotle says. And if he should tell the tyrants’ usual lie, that he applies that profit to the public advantage, he must not be believed, because he might as well take my coat and say he needed it for the public service.

The euphemisms for fiat money printing are legion: “loans,” “debt,” “bond issue” or some other financial instrument that implies being paid back. This is to give the illusion that the value is being taken, not from the holders of the dollar, but from some specific entity that lent it the money and that the debt will be paid back in some way later. This is the ethical equivalent of seizing my coat and saying it’ll be given back later because the government has need of it. At the very least, I should be compensated for the fact that my coat is being used by the government.

And indeed, there is compensation being paid by the government, but it doesn’t go to you or me, it goes to the Central Bank, or more precisely, the private and undisclosed shareholders of the member banks of the Federal Reserve in the form of interest. So in a way, someone else gets compensated to borrow your goods! Imagine if the government seized your car for 6 months and compensates some banker you’ve never met that doesn’t have anything to do with your car. That’s what’s happening when the Fed expands the money supply.

As Oresme says above, monetary expansion is an unjust seizure of wealth. The open and honest way for any government to pay for its services would be to explicitly tax the citizens. People generally don’t like taxes so will not consent without a really good reason. This is how governments were held accountable in hard money societies, as government couldn’t tax too much without a revolt.

Yet the government can and does tax its citizens, just not explicitly or openly. Instead it does so covertly and implicitly through inflation. By this mechanism, it satisfies the right by having low explicit taxes and the left by providing lots of government services. Deficit spending/monetary expansion is a loophole that every government has exploited to tax its citizens for the last 50–100 years.

How Bitcoin Is Different

Bitcoin has two unique qualities which make it especially fair. First, it is near impossible to counterfeit. Anyone running a full node can check quite easily whether the bitcoins they received are genuine (spoiler: BCH is not bitcoin nor is BSV). That is, Bitcoin is easily recognizable and cannot be faked.

Second, it is impossible to inflate Bitcoin beyond the supply schedule created at its inception. The entire community of full node operators and bitcoin holders would have to agree to make that happen (spoiler: it won’t). That is, it’s a hard money with a hard cap.

These are specifically the two properties that make implicit/covert taxation so difficult and incentivizes an open and honest government. No longer can the sovereign just print more money to fund its latest program, it would either have to save revenue from prior years, cut some other program or tax the populace to pay for it. The loophole of deficit spending, which is really just printing more money and imposing an implicit tax on all dollar holders, is closed and spending has to be aligned with revenue.

Oresme’s insight that money belongs to everyone that owns it reveals a fundamental truth: monetary expansion violates the property rights of everyone who holds the money. Bitcoin is the first money to enforce the ideal that the money belongs to everyone who holds it, and not some authority that claims it with threats of violence.

Bitcoin is the first money that makes the monetary abuse by authorities impossible. Bitcoin is impossible to inflate without consent from everyone. On a Bitcoin Standard, the path that governments have to take in order to raise revenue is to get explicit consent for taxes instead of implicit theft through inflation.

Conclusion

The monetary system that we’re under is a tyranny. The Fed is an independent organization and is not accountable to voters. Furthermore, the dollar standard means that inflation gets exported to people outside the US, who have even less say. The dollar hegemony is an unjust system where the wealth of the world is controlled by an organization that’s able to tax without anyone’s consent.

The rallying cry of 1776 was “no taxation without representation.” The entire world is being taxed by an organization in which only the very powerful and rich have representation. It’s time to end the Fed.

This isn’t a new sentiment. Ron Paul wrote a book about it over a decade ago. But now, we can do something about it outside of our broken political system. We can buy bitcoin and declare monetary independence. Real justice means economic justice. Fairness means a system that isn’t rigged. Bitcoin propels meritocracies. Bitcoin expunges systemic unfairness.

The system is rigged. Bitcoin fixes this.

Comments are closed