The past two years have seen a flurry of productive activity in the Bitcoin space. Taproot has brought in lots of new interesting possibilities from Schnorr Signatures enabling smaller on-chain lightning channel transactions to TapScript Merkle Trees bringing the innovative way to prove the execution of a program through BitVM. These are truly new and novel things in Bitcoin and they have been genuinely good for the Bitcoin ecosystem.

But that’s not the full story of the last two years in Bitcoin, and as much as I’d love to write about the actual innovation, I have to deal with the fake, stupid, immoral and fiat scam that is ordinals. It’s not a job that I enjoy, but given the asymmetry of the arguments, one side that’s incentivized to pump it against an unfunded debunkers who talk about it objectively, there’s some much-needed cold water that needs to be poured on their prospects and I’m here to deliver.

For most normal people, the idea of NFTs, unique digital property seems pretty dumb on its face. Whether it’s a jpeg or a short video clip or whatever, they rightly ask after having the whole concept explained to them, “wait, that’s it? I’m not missing something here?” I’ve written about them in the past, how they’re a vehicle for scams in much the same way altcoins are. I’d go so far as to call NFTs altcoins, as they’re an alternative and the T in NFT marks them as a coin. What’s especially confusing for normies is this concept of a bitcoin NFT or ordinals. Does that mean that somehow it’s better or purer than the ones on Ethereum or Solana? They’re not, but we’re getting ahead of ourselves. Let’s start at the beginning.

Trolls Gonna Troll

The whole “fad” started with Rod Armor, who inscribed a skull in using the witness discount in late 2022. It wasn’t really even noticed by the network as it was a mere 793 bytes, well within the normal range of transaction sizes.

What really got it going was Taproot Wizards group, who are a disaffected group of “former” Bitcoin Maximalists that wanted revenge after getting humiliated supporting a whole bunch of affinity scams like BlockFi, Celsius and of course, FTX. Their intent wasn’t to create a new asset class, they realized that inscriptions were the perfect vehicle to fill certain blocks with noise for the sake of making Bitcoiners angry. So they inscribed a 4MB jpeg in early 2023 and a new market to make Bitcoin Maximalists angry began, which by August 2023 was an insane 21 million inscriptions on the Bitcoin blockchain. Though the rhetoric now is that inscriptions were some sort of new thing being “built on Bitcoin,” nobody really noticed until this very obvious and continuous troll.

Also in early 2023, ordinals began, and given that there were a lot of degenerate altcoiners that would buy and sell pretty much anything, what got attention as a troll quickly pivoted to a business. BRC-20 tokens started soon after and stamps not much longer after that. Trading activity picked up and soon, they traded in various exchanges. And these trolls have definitely made some money, especially from VCs who are all too willing to sacrifice their Bitcoin bona-fides for the prospect of some ROI. The troll put on a business suit and began arguing with Bitcoiners that they were a legitimate part of the Bitcoin ecosystem.

Ordinals, the argument

Ask any ordinals supporter why they think ordinals are good for Bitcoin and they immediately change the topic to “rights” and “you can’t stop it” and so on. Instead of telling Bitcoiners what they bring to the table, they focus on why the protocol doesn’t stop them. Like shop lifters in San Francisco, they don’t bring anything good to the table, so they focus the discussion on how there’s nobody that’s going to stop them from doing what they want. But of course, just because you can do something doesn’t mean you should. To paraphrase Chris Rock, you can drive with your feet, but that doesn’t make it a good idea.

In other words, they don’t have a good answer. They have bad ones, though, if you press them. Somehow it supports miners by giving them money. Or it undermines other altcoin launching platforms. Or making Bitcoin “fun.” All these are very weak arguments and they don’t talk about how their projects change the incentives or undermine the monetary use-case, which is why they don’t make them that often. The discussion they want to have is that they “can” inscribe or put ordinals or stamps on the Bitcoin blockchain, which as stated above is confusing could and should.

Why Are They on Bitcoin?

My gripe with NFTs in general have been that there’s no technical reason for them to be on a blockchain. They’re already clearly centralized. They have an issuer. You can’t look at the ordinal without some other software which decides what it represents. Some other trusted entity decides whether you have the ordinal or not. If they change the rules in the future and you get the short end of the stick? Tough luck for you. They’re no different in centralization than the run-of-the-mill forgotten altcoin from 2011.

So if they’re centralized, why are they on a blockchain? A blockchain is a horribly cumbersome database to hold digital data. It’s hard to develop, hard to scale, costly to maintain, and difficult to upgrade because they’re voluntary. So from a purely technical point of view, a centralized project on any blockchain, let alone the decentralized one in Bitcoin, doesn’t make any sense. It’s much easier, faster, cheaper and more maintainable in a centralized database.

Technically speaking, a centralized project becomes more difficult in every way on the Bitcoin blockchain.

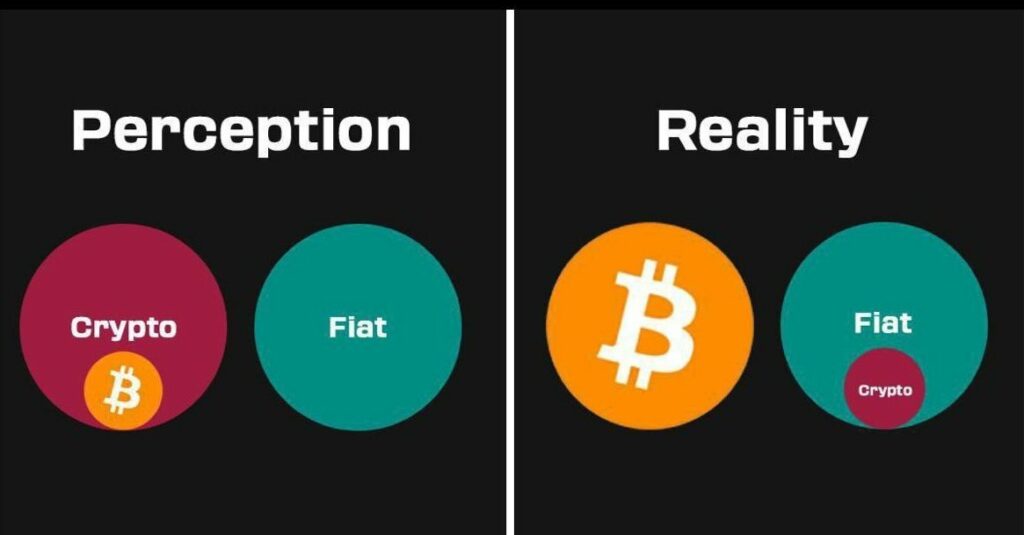

So what’s the real reason why ordinals are on the Bitcoin blockchain? Because there’s a large market of people to market to. Because it’s easy to hype by associating it with Bitcoin’s historical success. Bitcoin represents, hope, freedom, self-sovereignty, sound money, and a better world. It’s an amazing thing and to even be slightly associated with it, as altcoins have over the past 13 years. But altcoins have a long history of going comatose, so ordinals are the new argument, a new way to sell old, outdated, failed ideas. In other words, ordinals are on Bitcoin because it’s a new way to scam a market that has wised up a bit.

Anticipating the VC-funded Responses

Now the ordinals people will undoubtedly make excuses for why it needs to be on Bitcoin. You can’t manipulate it! It’s less work and requires real payments! Both of which are true. Bitcoin is secured by proof-of-work and that means anything embedded in it requires astronomical amounts of hashing power to change. But you don’t need to use Bitcoin to do that. There are timestamp servers and receipts and backup services all of which are way cheaper and provide the same service without bloating the Bitcoin blockchain. And Bitcoin’s blockchain is no real protection. You have to use other software to figure out whether you own an ordinal or an inscription or whatever. That software can change the rules anytime they want, just like any altcoin software. And these things aren’t generally backwards compatible. So if you’re running something old? You’re not following the centralized “consensus.”

Ordinals, like NFTs and really every altcoin, are a glorified spreadsheet that can just as easily be run on a $500 website while providing cryptographic proof that it hasn’t been manipulated. Again, the only reason ordinals are on Bitcoin is to create more demand through marketing it as something that “helps” Bitcoin, which is like saying that spam helps email adoption.

Conclusion

For many years, altcoins have ridden the coattails of Bitcoin to scam lots of people. It’s getting harder to scam the same people and indeed there are currently only two paths left. There’s the post-modern nihilistic tactics most fully realized in memecoins. Altcoins no longer purport to have real-world utility anymore. That ship sailed back in 2019. They are forced to go to memecoins because the market doesn’t appreciate being lied to. Memecoins have no utility, no disruption of any industry, no innovation and no prospects, but at least they’re honest about it.

The other way is to associate closer with Bitcoin than altcoins have been. It’s not enough to be a “cryptocurrency” anymore, to affinity scam now, you have to pretend you’re a Bitcoin Maximalist.

The actual technical reality of these projects is not new. Colored coins were live back in 2013, as were MasterCoin and Counterparty. But the cultural pivot is. Ordinals, inscriptions, BRC-20, stamps are all trying to clothe themselves with Bitcoin so the general public associates the benefits of Bitcoin with these projects. But of course, the values of these projects are antithetical to Bitcoin. There’s no self-sovereignty, financial freedom, decentralization or really any hope for the future in these projects, just straight gambling. So they borrow the good values as much as they can from Bitcoin.

Fiat in English literally means creating something by decree. And these new types of altcoins are fiat in that strict sense. They’re decrees by a centralized authority masquerading as a decentralized project by associating with Bitcoin.

Meet the new altcoins. Same as the old altcoins.

Comments are closed