Why the UASF Segwit Scenario is Hopelessly Naive

Recently, there’s been a 20-slide presentation being posted all over the place and though I’ve written about how UASF would play out, I will, in the spirit of open debate, respond to this deck directly.

Let’s begin with slide 1.

Flag Day

This is assuming a flag-day activation of UASF. There are a number of assumptions built into this scenario, which I’ll explain as we go on, but the first thing I want you to notice is that flag day “d” is agreed upon. This may seem like a simple problem, but it’s not. In fact, proof-of-work is one of the only known ways to solve it.

You may argue that flag day is easy to set. Just pick a day and let everyone declare whether they’re with you or against you. I’ll admit you can agree to a date easily, but it doesn’t mean everyone who agrees is being truthful or bound in any way. A miner, for instance, may say they’ll signal for your change on flag day and then suddenly “delay” their implementation way past flag day because their software hasn’t been completed. A merchant may say they’ll soft-fork with you and then suddenly “discover” that they haven’t tested enough.

But let’s say UASF proponents somehow find a way around the Byzantine General’s Problem. Say everyone is impeccably honest. What then?

UASF Signaling

Notice that miners are signaling for UASF. I want this to be absolutely clear. This is different than current signaling for Segwit. Segwit that miners are signaling for now on both Litecoin and Bitcoin are designed to activate automatically (let’s call this MASF for miner-activated soft fork) at 75% signaling and 95% signaling respectively. That’s currently what miners are signaling for and not UASF Segwit. No such bit is currently assigned per BIP9 as far as I know and no one has signaled yet.

It’s possible miners that are signaling MASF Segwit would also signal UASF Segwit, but there’s no guarantee of that. There are unique risks to miners in a UASF Segwit which I’ll discuss later which changes the risk profile of such a move. Also, miners false signaling may be advantageous in some scenarios.

Let’s say this isn’t a problem either. Miners who are supporting MASF Segwit now will ignore the risks of UASF and just signal exactly the same way. What then?

Exchange Risk

There are two ways for an exchange to announce support of trading in a split chain. One way is being done already with Bitcoin Unlimited at Bitfinex and that’s using a futures market. The other way would be to actually trade the coins on both forks.

The latter way would be an excellent way for an exchange to go bankrupt. As slide 17 shows, one of the chains can entirely disappear. That means transactions, such as the one depositing coins to the exchange from the old chain are as if they never happened. So if I have 100 Bitcoins before the soft fork, I can deposit 100 Bitcoins from the old chain to this exchange, sell them for some amount of money (say $10,000), withdraw the money and when the chain disappears, the exchange is out $10,000.

This is not an unfamiliar risk in Bitcoin. It’s called a double-spend and most exchanges require at least 2 confirmations before accepting a deposit. However in a UASF scenario, there isn’t a safe number of confirmations since the entire old chain after the fork (which can be very long indeed) can be wiped away.

But let’s say an exchange is willing to take this risk and trade anyway, what then?

Complete Freeze

At this point, the chains have split. Other than the exchange above which is bravely taking on double-spending risk, most other people/businesses don’t take any payments on the old chain as it may disappear (see Slide 17). Actually, most other people/businesses don’t take any payments on the new chain either since that transaction can be replayed on the old chain.

Basically, Bitcoin transactions are likely to stop for a while until these issues are solved. The only known way to solve these issues is to make the chains completely incompatible, making the chains permanently fork. More on that in a moment.

In the meantime, nobody transacts, so what happens?

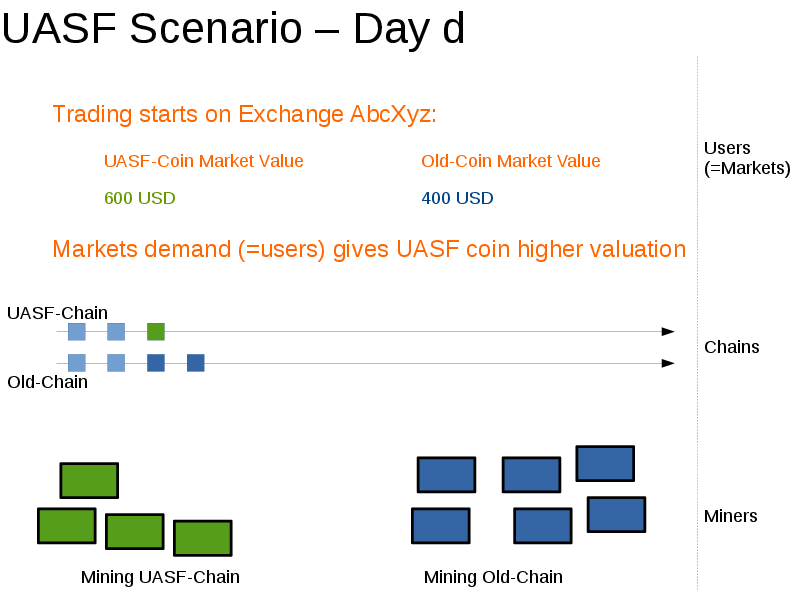

Exchange Crash

Our brave exchange is trading coins on both chains. Everyone that had coins on the exchange before the split can now sell the same amount of both coins. Since Bitcoin is now unusable and nobody can really transfer bitcoins anywhere, everyone buys dollars on both chains. The price of coins on both chains crash since that’s the easiest way to get value out.

It is at this point that it’s in everyone’s interest to permanently fork. That is, remove the possibility of the forks joining back as in slide 17. This allows both chains to be traded, priced, etc. but the old chain cannot disappear.

What then?

Miner Motivation

Assuming the fork is now permanent, it all depends on the miner split. If the split is asymmetric (10/90), miners may just abandon the shorter chain as that chain will be pretty unusable (you’d have to wait 100 minutes for 1 confirmation).

It is for this reason that most miners will not want to signal before a fork which way they will go. Generally, they’ll want to mine on the one that’s more valuable and that very well may be the one that has a majority.

This is true, but assumes that miners only move in one direction due to Slide 17. But this is simply not the case. Miners will move in both directions and if they’re really being tricky, they may move into a chain they don’t want to see succeed and mine only empty blocks there. The more asymmetric the split is, the more shenanigans miners can pull on the minority. This may lead the minority chain to do a proof-of-work change or something else similarly drastic.

Note a lot of these miners can stave off short-term profit for long-term gain. Their balance sheets are flush and mining is very profitable right now after the BTC price increase the last 6 months. Don’t assume short-term profit is what miners are after. Some will forego short-term gain to win a bigger share down the road.

Chain Disappearance or Reorg Risk

This is, hands down, the most unlikely part of the scenario. You cannot have price discovery before a permanent fork and there is no way miners on a chain that has chain disappearance risk would allow it to happen. Heck, Jihan Wu has Tweeted that they’re preparing for a permanent fork in case of a UASF:

There is no doubt as soon as there’s a fork, that this would be deployed and this wouldn’t be a bad thing! This is the only way that Bitcoin is at all usable after the fork.

The Aftermath

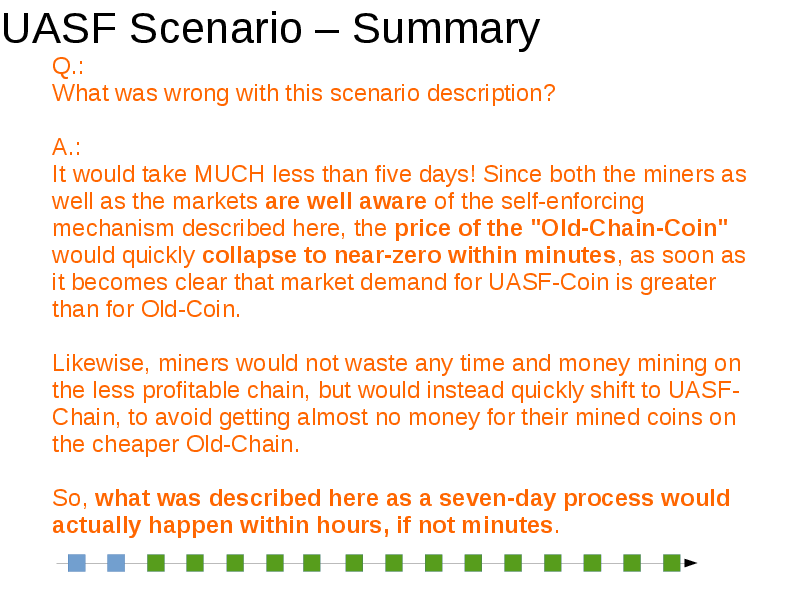

OK, I lied, this is the most ridiculous slide in this deck. There is no way anything settles in minutes unless nobody mines on the UASF chain (a strong possibility).

The scenario laid out in this slide can only happen if there’s a super-majority of miners on UASF. But the only way we get to a UASF in the first place is if there isn’t a super-majority signaling for MASF, so there’s no way a super-majority of miners would support a UASF as it’s riskier.

Conclusion

For what it’s worth, very similar analysis applies to Bitcoin Unlimited as well or any other contentious hard or soft fork. Very quickly, the market will find that a permanent fork is needed to add pricing information and come close to some sort of resolution.

This presentation is like a chess player that assumes the other side doesn’t move its pieces at all (well, if I can do 20 moves without the other side making any, I can checkmate!). This is frankly a naive approach to game theory and won’t work in the real world.

Much more likely is a very painful divorce that will result in two coins more authoritarian than Bitcoin is now.

Comments are closed