Just How Profitable is Bitmain?

Editor’s Note: I originally intended this to be an edit to my last article, but it became interesting enough to just make a whole article out of it. Thank you to my friends in the semi-conductor industry that helped me with this.

In running some numbers for my last article, I ran into one small problem in assigning how much it costs Bitmain to run their mining pool. I didn’t know their profit margins for their miners and simply used their current retail pricing for their S9 miners ($1200). Of course, the retail price is certainly not the production cost for Bitmain, but I had no idea what that was, so I used the easiest number I had available.

In this article, I’m going to estimate Bitmain’s profits and hopefully shed light on what $2M may or may not mean for them.

Cost of Production

Profit, as any high schooler knows, is the difference between amount earned minus the amount spent. The amount earned per S9 sold is $1200 at the time of this writing. The amount spent is the harder part to figure out.

Generally speaking, chip fabrication is the most expensive part of the miner build. Thankfully, chip fabrication costs are fairly standard for a given process and we can figure out how much they cost with a little digging and math.

We know that Bitmain uses TSMC’s 16nm process to build their BM1387 chips. A little googling will tell you that TSMC’s production cost per wafer of the 16nm process is around $4000. Their gross margins are around 45%, so we can assume that the cost per wafer to Bitmain is around $8000.

If you know the die-size of the chip, you can figure out exactly how many chips you can print per wafer. The Bitmain BM1387 chip is somewhere below 20 mm² in die size, and though it isn’t published, looks to be 3mm x 4mm by measuring the inside.

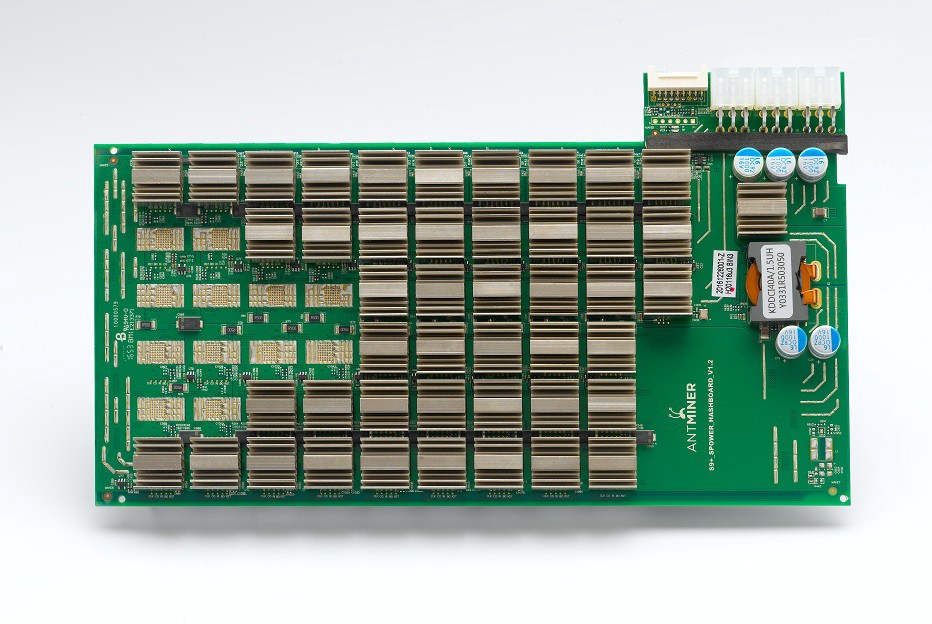

We can plug in these numbers to a die-per-wafer calculator and get 5158 chips per wafer (we’re using the 300mm/12″ wafers as is industry standard). Each S9 miner uses 189 such chips, so each wafer can make enough chips for a little over 27 S9’s. Each wafer costs around $8000, so the chips for each S9 costs roughly $300.

The rest of the parts are fairly standard and my semiconductor friends tell me it’s probably not more than $200 in bulk (power supply, heat sinks, controller, PCB, etc), we can estimate the cost of production of the S9 to be roughly $500.

Of course, this doesn’t include all the one-time engineering costs like design, tape-out, testing, etc (for 16nm processes, less than $10M according to my semiconductor friends). But given how many miners have been sold by Bitmain and how long the BM1387 has been on the market (S9 was $2100 at launch!), we can safely assume that they’ve recouped those costs already (probably in the first month, at the most).

Profits from Mining

With the above, we can recalculate just how much Bitmain makes from their mining operations. We know they’ll get roughly 100,000 BTC/yr ($120M/yr) if their hashing power stays at around 13.2% (500PH/s for now). The electricity costs + data center costs are roughly $23M/yr. Their mining equipment costs are a lot less than my last estimate from before (40,000 * $500 = $20M/yr). They’ll make $77M this year at current BTC rates.

Further, their break-even point is at $430/BTC (their equilibrium point is still at $130/BTC). No wonder they’ve been able to survive where most mining manufacturers went bankrupt during Bitcoin’s 3 year bear market!

Profits from Selling

Given the above, we can also estimate how much money Bitmain makes from selling equipment. If we estimate that around 2/3 of the network hashing power is supplied by their mining chips (some say less, some say more), that means around 53% of the mining equipment hashing right now is controlled by their customers, but not Bitmain. That’s roughly 200,000 S9 units, each of which give a $700 profit to Bitmain. That’s a total of $140M in profit from selling the equipment.

Note that equipment sales is a lot less volatile than mining operation. Mining operation is very dependent on Bitcoin price whereas sales is not. For a business like Bitmain, it would make a lot more sense to sell the equipment and get steadier, less volatile profits than to solely mine.

Is Bitmain Using Covert ASICBoost or Not?

As I’ve shown, $2M really isn’t very much for them and given their scale, they probably have a much better return on investment on other projects. We know for example, that they don’t liquid-cool their miners which BitFury does. If we assume Bitmain could get the same increase in hash rate (30%) as BitFury does through liquid cooling, their mining profits would increase at least $20M, a much better return on investment than covert ASICBoost.

Hence, while it’s possible they are using covert ASICBoost, if they don’t it wouldn’t be surprising. Let’s just say that it’s probably not high on their list of priorities if covert ASICBoost hasn’t been done yet and not a high priority to keep if it has.

Conclusion

Bitmain will probably make around $200M-$250M in profits this year just from their BM1387 chip (they have other products, including a Scrypt ASIC). Even after including ongoing R&D and other future investment, they are likely worth well over $1 Billion as a business and are probably the largest and most profitable company in Bitcoin.

Their dominance, however, is not likely to last forever. The margins are simply too high for competitors to not come into this space. Should BTC price stay at or above current levels for a while, I would expect more companies to come into the ASIC manufacturing business. This would make mining equipment cheaper and add more options for customers. Unfortunately, semiconductor manufacturing requires long lead times so I don’t expect competitors to come in for at least 6–12 months.

Bitmain has gotten to where they are because they’re extraordinarily good at what they do. This is a good thing as this means the ecosystem is maturing (remember Butterfly Labs?). Expect this level of efficiency and scale in Bitcoin going forward.

Want to get curated Technical Bitcoin News? Sign up for the Bitcoin Tech Talk newsletter!

Comments are closed