Latin American Bitcoin Perspectives

This is a short musing based on some conversations from yesterday that’s too long for a Tweet.

Part of the joy, and frustration, of traveling is that different places have a very different perspectives. It’s easy to be limited to a very narrow view of the world and think that it’s broad. Traveling is the antidote to this deception.

The problem is even worse in tech as Silicon Valley has hegemony over what’s innovative. Thus, the ubiquitous, and wrong, perspective that Bitcoin is mainly a technology that needs iterating, changes, governance by technocrats.

The Latin American perspective in this regard is refreshing. They already know that central bank monetary expansion is a big problem and see Bitcoin’s store of value property as a way to get out from under it. They’ve gone through huge currency devaluations and have learned already not to store value in their local currency. In other words, they have hard earned wisdom that Silicon Valley does not have.

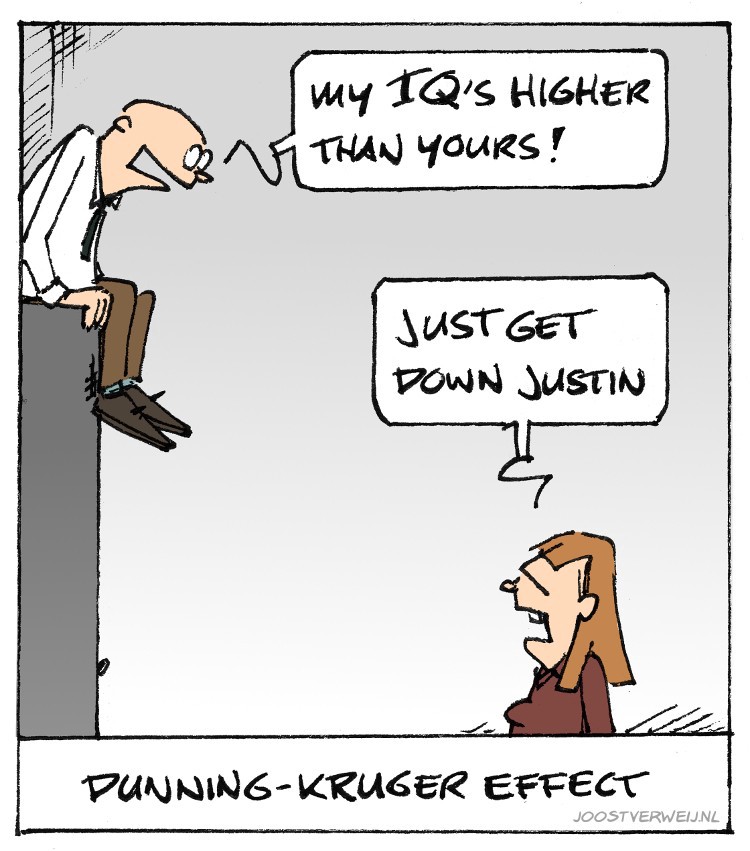

Silicon Valley Arrogance

Money makes people think that they know more than they do and so does being technical. It’s a special form of the Dunning-Kruger effect that affects many technical people, but Silicon Valley especially. Wealth and prosperity blind them from entire categories of knowledge that only come in times of poverty.

The US hasn’t had to suffer much from its own monetary expansion the last 75 years as the world is on the dollar standard. It’s only when you look from outside the US, and particularly outside SF/NYC that you can see how much monetary expansion matters.

Bitcoin Really Fixes This

laBitConf has been going for 7 years, in part because of the obviousness of Bitcoin as a store of value. A lot of people have been able to avoid the crippling monetary expansion that’s been a constant reality in this region.

So why is it that so much of this gets ignored in the more prosperous countries? Mostly, it’s because they haven’t had to suffer from monetary expansion and therefore trust their central banks. There’s a perception that countries which suffer from currency devaluation do so through incompetence. They reason that such crazy devaluations would never happen in their own country. Little do they realize that central banks have had to do more and more for less and less effect.

In a sense, Bitcoin is a bet against central banks being able to keep the shell game up. The more you trust central bankers, the more you’ll dismiss Bitcoin’s store of value property and the more you’ll play up idiocies like Turing-complete smart contracts and blockchains-fix-everything.

Comments are closed