On Altcoin Valuation

Bitcoin has value because it’s decentralized digital money. It has a stock/flow ratio that continues to increase and a scarcity enforced by a highly credible monetary policy that no physical asset can ever have. In addition, Bitcoin has a huge network which has made it the Schelling Point, security that’s extremely expensive to subvert and a history that no crypto asset can match. Some nascent research has suggested that stock to flow is a fundamental measure of value for Bitcoin, which makes sense as Bitcoin is really decentralized.

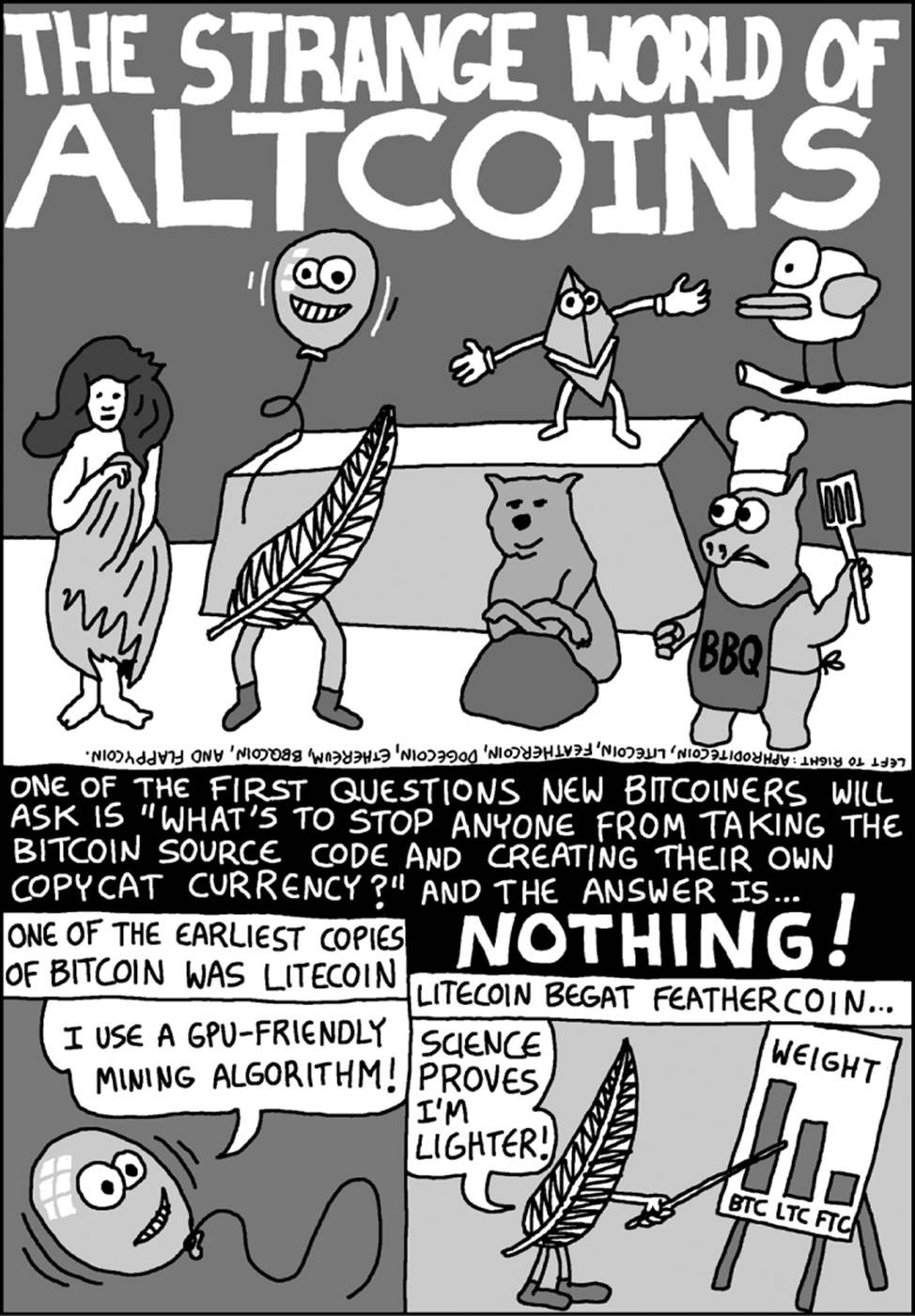

Altcoins are a different story. They all lack the one major innovation that Bitcoin has: decentralization. This means that altcoins are fundamentally different from Bitcoin and are closer to fiat money. Their central points of failure can and have been used by outside parties to influence or even control. Centralization is why the stock to flow model does not work at all for altcoins but does so for Bitcoin. So what gives altcoins value? Why do altcoins have any price?

In this article, I hope to explore this very question. Do altcoins add valuable new technical features? Are their buyers hoping for a path towards decentralization? What made Litecoin successful while its earlier, very similar cousin Fairbrix fail? Why did coins with a large premine like IxCoin fail while one like Ethereum succeed? To what can we attribute these relative successes and failures?

The Myth of Technical Innovation

Talk to any altcoin holder and they will inevitably argue that their coin is the one with the most interesting features. They argue that their coin will revolutionize some industry by doing something that will make the tokens worth more, usually through some convoluted set of hand-wavy incentives. The hope, of course, is that their coin will be “the next Bitcoin” as a result of some new feature and become the new Schelling Point for a global currency.

This is little more than wishful thinking as any holder of previous pretenders to the throne can tell you. From Feathercoin to Auroracoin to Steem, there have been many coins that offered some supposed technical advantage but failed to maintain traction, let alone dethrone Bitcoin.

The technical features include stuff like faster block times, proof-of-something other than work, change of hashing algorithms, change in monetary policy, expansion of block size, promises of privacy, a utility for a particular service, solving some problem in some specific industry and so on.

All of these are at best wishful thinking as their community is limited to the demoralized and/or deluded token holders that continue to hope for a miraculous Bitcoin dethronement. The technical merits of the “innovations” are often found severely wanting (Turing complete smart contracts), if not outright fraudulent (Bitconnect), but even the few that have some merit are so hopelessly lost in a quagmire of badly designed incentives that they solve no real world problems.

All that is to say that technical innovation in altcoins is almost always a complete miss. Real innovation finds a market. These altcoins haven’t found any real users for their stated goal and very few have managed to have any volume of any kind whatsoever.

As most altcoins are open source, forking the coin and changing a few parameters to create a technical clone is quite simple. If technology or features were the basis of value, technical clones would have significant value. Such clones don’t, so this indicates technical features are not the reason for their value.

No, what separates the valuable altcoins from the valueless is not technical improvements at all, but something else.

The Story of Litecoin and Fairbrix

The story of altcoin valuation starts here because Fairbrix and Litecoin are two very similar coins. They have the same proof-of-work, a similar launch date (2011) and the same creator: Charlie Lee.

Both of these coins were based off of Tenebrix, which was an altcoin launched in 2011 using a then-new proof-of-work algorithm, Scrypt and a slightly faster block time versus Bitcoin’s 10 minutes. The community at the time objected to Tenebrix because of a large premine, leading Charlie Lee to fork Tenebrix to create Fairbrix. Much like how Zclassic would fork Zcash much later, Fairbrix was a clone of Tenebrix without the premine.

Of course, Fairbrix went nowhere and therein was the brilliance of Charlie Lee’s strategy. He took the same features and created another coin, Litecoin and branded it better. He changed the block time from 5 minutes to 2.5 minutes and worked out a few bugs and gave the coin much better marketing. His most keen insight as he would say to many people over the years, is that he gave Litecoin a catchy slogan: Silver to Bitcoin’s gold.

From a technical standpoint, this was a minimal set of new features. The one major change in the coin is the change in the proof-of-work algorithm which was copied from Tenebrix. The effort into integrating Scrypt was not exactly great engineering. For example, the block hashes in Litecoin are indistinguishable from transaction hashes. This is not the case in Bitcoin as block hashes all start with a bunch of 0-bytes, making block hashes obvious. Likewise, none of the small design errors in Bitcoin, like the OP_CHECKMULTISIG off by one bug or the 4-byte timestamp were corrected. Litecoin was essentially a clone with a few minor tweaks and good marketing.

There were a lot of coins created in the 2011 era that haven’t really survived, including IxCoin, SolidCoin, Geistgeld and Litecoin’s brother Fairbrix and father Tenebrix. The marketing deathblow for some would be a premine, which many in the community would condemn, but as Fairbrix shows, the lack of a premine didn’t guarantee an altcoin’s success, either. What made Litecoin popular was its clever marketing and technical features had very little to do with its success.

So why did these coins show up when they did? Mid-2011 was the first major Bitcoin bubble, going from less than $1 earlier in the year to $30 by July. All of the above-mentioned coins came shortly after the bubble popped starting in August. Many call this the “Scambrian explosion” of 2011. Given that all these coins started shortly after the bubble, there would seem to be at least some correlation. We would see similar Scambrian explosions in the subsequent bubbles of 2013 and 2017.

Mastercoin vs. Counterparty vs. Ethereum

Fast forward to 2013 and we can see another group of altcoins entering the picture. Mastercoin launched that summer, followed by Counterparty a few months later and the Ethereum presale in early 2014. All three were after the same mantle, that of a platform for launching new tokens. Mastercoin was dubiously the first to do a token presale before any product was built, or what we would today call an ICO. Mastercoin’s presale followed shortly after the April 2013 bubble during the summer of 2013. The token would languish for years until the 2017 pump.

Counterparty was a response to Mastercoin, requiring Bitcoins to be burned instead of donated. Bitcoins had to be sent to an address which would require breaking some cryptography to redeem in order to get XCP tokens. Counterparty launched a few months after Mastercoin in 2013.

Of particular interest was the fact that after Ethereum’s ICO in 2014, all of the supposed new technical capabilities of Ethereum (the capabilities of the Solidity language) were added to Counterparty. Ethereum responded by showing that the Counterparty smart contract platform could just as easily be done on Ethereum. In essence, the two coins were feature-for-feature at the same level.

What made Ethereum much more successful than either Mastercoin or Counterparty was the unprecedented amount of marketing that went into the token sale. Not only was the ICO amount far larger than any previous one (30,000 BTC), but the premine that they had was sold to the public as a good thing, as a way to fund continuing development and marketing. As Vitalik has said, he made premines acceptable in a way that the 2011 batch of coins did not.

The marketing driving the ETH presale dwarfed that of any other coin coming before and as a result, despite a lot of similarities in feature sets to Counterparty, Ethereum was able to succeed in the 2017 bull market in a way that the other tokens did not.

To say that this looked crazy to any rational investor at the time Ethereum launched is to understate the case. The complete lack of investor protections in their token sale and the ridiculous 72M premine made, for many, ETH dead in the water. In addition, there were several high-profile delays in launching as well as funding problems during the year and a half they spent building Ethereum.

Technically speaking, there are so many shortcomings in Ethereum that they’re planning to scrap the entire infrastructure for Ethereum 2.0! There have been numerous documented problems from the DAO to the Parity Bug to the fact that ETH addresses lack a checksum. Yet all of these problems have essentially been ignored by the market. The technical realities of Ethereum do not seem to matter to the investors.

In other words, Ethereum was able to overcome all of those problems with what can only be described as insanely effective marketing. In a sense, Ethereum is the precedent for all the different coins that have raised billions without any code or investor protections. They’ve also shown that even hopelessly insecure systems can thrive with enough marketing. When it comes to altcoins, marketing overcomes all.

The Curious Case of Ripple

XRP was the first token to be entirely premined and launched in 2012. Interestingly, the token languished in the sub-billion market cap range all the way until 2017, when it rode the wave of the Bitcoin bull market to a cool $127 billion market cap at its peak. Somehow, XRP wasn’t a part of the April 2013 or November 2013 bubbles and yet burst through during the 2017 one.

So what changed? How was an asset that was languishing for a good 5 years suddenly so popular? There seem to be several reasons, with more effective marketing during the bull run being one and the low unit price being the other.

The main marketing message for Ripple was always that they would be a coin that’s for corporations and big institutions. It’s an excellent marketing story as no other coin at the time of its creation claimed that mantle.

In addition, there appeared on Twitter the XRP Army in 2017 which relentlessly promoted the coin. Ripple Labs also sent out many press releases which, even when unrelated to XRP, caused the price of the token to go up. Having a corporation at the center seems to have aided the marketing efforts of XRP as it was much easier to send out press releases and throw parties and so on that would bring publicity.

In other words, by 2017, Ripple Labs stepped up their marketing game by leveraging its advantages as a corporation.

From a technical standpoint, Ripple is extremely centralized with software that calls home to upgrade and no way to resolve differences between different database states. Yet the marketing of Ripple and the XRP army obscure this on a daily basis. Technical reality and marketing, it seems, don’t need any alignment whatsoever.

Other altcoins since then have gone even further, creating or promising to create ecosystems in exchange for fully premined tokens. These tokens amount to gift cards to a store that has yet to be built and has no products or services yet with vague promises of opening at some point in the future.

BCH and BSV vs other BTC hard forks

2017 brought on another class of altcoins, which gave an airdrop to Bitcoin holders. BCH was the very first hard fork coin, but it did not stop there. 2017–2018 brought a lot more hard forks like Bitcoin Gold, Lightning Bitcoin, Bitcoin Private and many others which have not fared nearly as well. This is despite many of these coins having better technical features. Bitcoin Private, for example, inherited Zclassic’s shielded transactions (which in turn came from ZCash). Lightning Bitcoin has guaranteed 1 minute block times. Bitcoin Clean uses less energy and Bitcoin Interest gives owners staking income.

Why did these coins fail in comparison to BCH? What appealed about BCH was not the technical differences, like larger blocks or a lack of Segwit, but the marketing capabilities of people like Roger Ver, Calvin Ayre and Jihan Wu. Roger Ver uses the bitcoin.com domain to mislead people into thinking BCH is Bitcoin and Jihan Wu at one point forced customers of the popular Antminer series of Bitcoin miners to pay in BCH.

“I made bitcoin what it is today, and I’ll do it again with Bitcoin Cash”

— Roger Ver

Though utterly wrong about his influence on BTC, Roger Ver has the correct assessment of his role in BCH. Marketing has given BCH a huge advantage over the other hard fork coins. Roger Ver has spent a good deal of money sponsoring many conferences to promote BCH and bitcoin.com in 2018 (this has largely stopped in 2019).

The split between BCH and BSV is another precautionary tale as the market cap before the split was higher than the combined total after the split. The split in marketing efforts reduced the overall effectiveness leading to a lower combined market cap. Calvin Ayre and Craig Wright apparently had some marketing value for BCH which was lost to BSV.

Technically speaking, BCH has had a lot of documented problems and continues to put out dubious features. Note as with Litecoin, a lot of the design errors from Bitcoin like the OP_CHECKMULTISIG off-by-one bug or a 4-byte timestamp in the blockheader are not fixed, despite ample opportunity in the numerous hard forks since August 1, 2017 to do so.

Again, none of this seems to matter to the BCH holders. Marketing trumps all.

Why Altcoin Marketing Works

Marketing in crypto has a virtuous feedback cycle as anyone that buys a token tends to market the token to other people via word-of-mouth much more than any other product. The incentives are such that holders of a particular token do a lot of additional marketing for the coin, essentially for free. Altcoin creators euphemistically call such people their “community” which help promote the coin without any cost to the altcoin marketers. As such, the marketing money spent on altcoins has had out-sized returns.

Thus, the biggest factor for a large altcoin valuation is effective marketing and to a lesser degree the coordination of such efforts. Ironically, the more centralized an altcoin is, the better it tends to do. It’s not a coincidence that Ethereum and Ripple are the second and third biggest by market cap. They have strong centralized teams, one a foundation, the other a corporation that excel at effective marketing. BCH, which is fourth by market cap as of this writing, also has that same marketing centralization around Roger Ver, who owns the very valuable bitcoin.com domain.

Altcoins that aren’t good at marketing tend to do worse over time, even if they have strong technical teams. This includes coins like Monero, ZCash, Grin and Decred, all of which have strong cryptographers and programmers on their teams but struggle to do effective marketing. Still other altcoins have neither good marketing nor good technical teams and these do the worst of all.

The game that altcoins are playing is one of effective marketing. The most valuable coins have managed to create demand almost purely through marketing. In other words, the demand is largely artificial. The technical efforts can easily be copied, but marketing dollars cannot. This also explains why so many altcoins spend so much money on conference sponsorships, parties, airdrops, online ads and charitable contributions. The market cap of a coin tends to reflect the effectiveness of the coin’s marketing efforts.

Altcoin Trends

There are some clear trends on popular altcoins. Most altcoins are created right after a major Bitcoin bull market, going all the way back to 2011. Most altcoins, when they pump, do so at launch and during Bitcoin bull markets, which are clearly times when effective marketing is easiest when new s̶u̶c̶k̶e̶r̶s̶ ̶a̶r̶e̶ ̶b̶o̶r̶n̶ investors come in.

The technical details of a particular coin don’t seem to matter all that much. There’s no “fundamental” value to the technology or feature set, given that cloning coins is easy. Instead, technical “features” are more valuable for marketing purposes. All this is to say that the big reason altcoins have any value at all is because of marketing.

The bull markets also give these coins a fresh lease on life through renewed marketing efforts. They all ride the coattails of Bitcoin’s bullish runs. Even during these bull runs, altcoins still fail if they’ve stopped marketing.

Conclusion

So what does this all mean practically? This is good news for traders because it turns out the technical facts for altcoins don’t really matter! Traders can base their altcoin trades on market perception and not have to bother with any due diligence of difficult-to-understand products.

For investors, however, the conclusion should be jarring. Technical competence or utility potential do not matter at all for price. The market caps of altcoins only indicate how good a job the token’s marketing departments have done, not anything fundamental about the coin, like the quality of developers, the soundness of the idea or even the existence of a product. Popularity cannot be used as a proxy for technical competence, product potential or returns. Popularity for an altcoin does not indicate anything other than marketing effectiveness. Reality bears this out.

As a result of being able to hack past the normal due diligence that happens with an asset through really good marketing, there are a lot of scams in the altcoin space. The lack of fundamentals combined with the out-sized role of marketing has led to a perfect combination that make scamming lucrative and nearly risk-free. Many investors that could do no wrong in late-2017/early-2018 are now heavily underwater as a result.

Which ones are scams and which ones are legitimate? Given the very skewed incentives, the only reasonable thing to do is to treat every altcoin as a scam until proven otherwise. We can only hope that the market has learned in time for the next Bitcoin bull run.

Comments are closed